Better Pricing. Better Timing. Smarter Issuance.

Revolutionize treasury management by making complex financial capital decisions easy.

Our Methodology

A quantitative, empirical and peer-reviewed approach

Best-in-class approach

Quantitative assessment based on comparison to other comparable bonds to match similar market conditions.

Performance orientation

Bond performance is adjusted by neutralising macro factors.

DebtRay Engine

Combining science and technology

Master data

Pricing data

Market data

Issuance Pricing Analytics

Issuance Timing Analytics

Pricing Simulator

Timing Simulator

Bank Ranking

DebtRay's BondRanking Product Suite

BondRanking is purposely built to improve pricing and timing of bond issuances

DebtRay BondRanking evaluates the quality of a new issuance in

terms of pricing and timing. The aim is to make the specific

early secondary market development of new issuances visible -

not distorted by overall market developments for which an issuer

is not responsible. We apply statistical methods to make the

“pure” development visible. We leverage technology to scale data

processing, calculation, and simulation.

The BondRanking product suite offers the following analytics and

tool:

- Pricing and Timing Analytics

- Peer-group Analytics

- Timing Simulator

- Pricing Predictor

- BankRanking

Coverage Highlights

3000+

EUR-denominated bonds

400+

Issuers

100+

Issuance analytics

Issuance Analytics Highlights

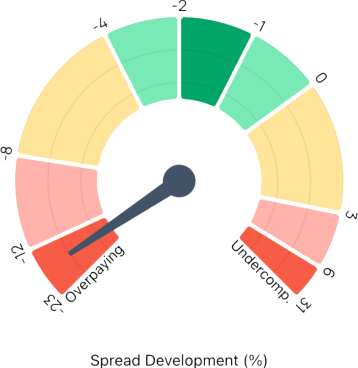

BondRanking Pricing

The Pricing quantitatively assesses the pricing efficiency of an issuance. It helps to answer the following questions:

- Was the pricing efficient, and if not, what would have been better?

- How was the pricing compared to peers?

- What is the potential financial impact of the inefficiencies?

Perfect pricing is not a coincidence but a skill of rising

importance.

Issuance Analytics Highlights

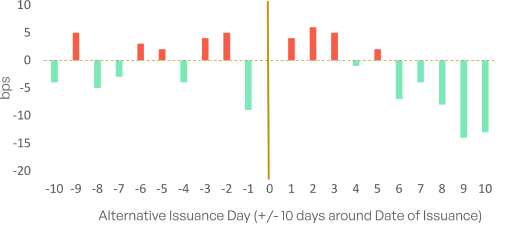

BondRanking Timing

The Timing analytics quantitatively assesses the timing of an issuance. It helps to answer the following questions:

- How was the timing, and would there have been a better point in time around the issuance date?

- How was the timing compared to peers?

- What is the financial impact?

Statistics reveal that achieving perfect timing is not a matter of luck, but a strategic outcome of meticulous preparation.

Improve your issuance today!

Book a Demo